Consolidated Financial Resources for Businesses

The impact of COVID-19 has been felt across the business community, and local, national and federal programs have been developed to offer financial relief. This page consolidates the options available to your business and provides insight about how to navigate the application process.

Updated as of September 25, 2020.

Note: If your business has received PPP loan approval, visit the Guidelines for Loan Forgiveness to review best practices or download the full forgiveness application guide (EZ Version). Guides will remain updated with new information released by the SBA.

Jump to a Section

CARES Act Funding

$349B

total available for the Paycheck Protection program

$10B

added to the Economic Injury Disaster Loan program

$17B

allocated to the Small Business Debt Relief program

Understanding the CARES Act

The Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law on March 27, 2020 and is designed to support individuals and businesses dealing with the economic and health impact of the coronavirus. The Small Business Administration (SBA) and the Department of Treasury are guiding the programs created through the CARES Act. On this page we will focus on the four, primary small business assistance programs covered under the CARES Act, which may be beneficial to your business.

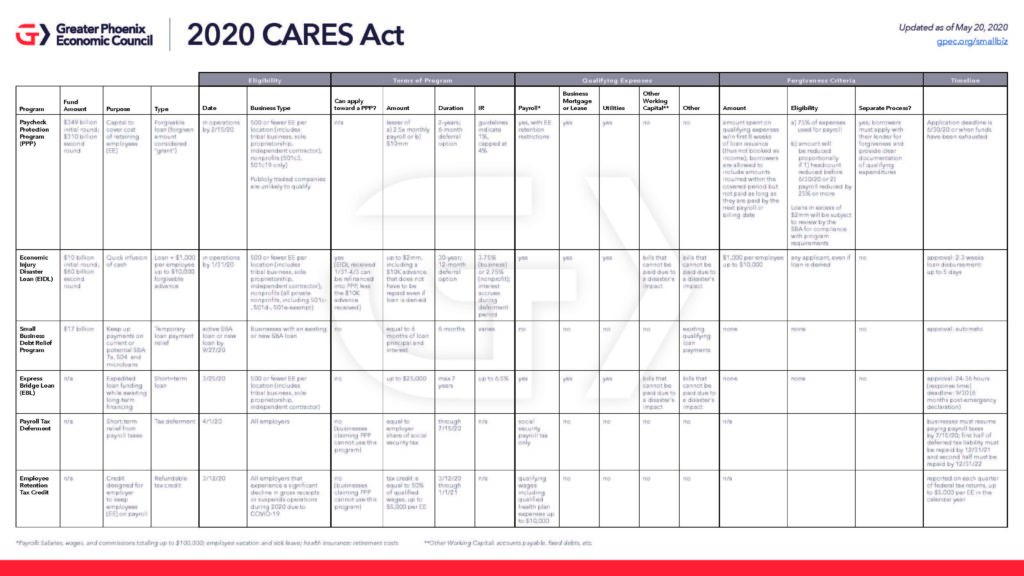

To learn more about the CARES Act, download our summary and reference the table below for how it may apply to your business.

Small Business Assistance Options - Federal

Determine the Right Option(s) for Your Business

These resources cover multiple small business assistance options to help you determine which is relevant to your business and how to navigate the application process. You should only apply to programs you qualify for, but there is no penalty for applying to multiple assistance programs, as long as funds are used for different purposes.

Are you a small business?

First, determine if your business size meets the eligibility standards set by the SBA. All businesses with fewer than 500 employees qualify. If you have greater than 500 employees, please use the Business Size Calculator to determine if you are eligible.

Small Business Application Guide

For a quick overview on the qualifications and how to apply for each of these programs, download our application guide.

AZ Commerce Authority (ACA)

Find quick answers to your questions on the ACA’s business assistance resource page, or download the current list of local SBA-approved lenders, compiled by the ACA team.

Arizona Small Business Development Center Network (AZSBDC)

SBDCs provides free one-on-one business counseling and resource assistance for small businesses.

Paycheck Protection Program (PPP)

Covers the compensation of your employee payroll, insurance, utilities and other operational expenses.

The Paycheck Protection Program (PPP) is designed to provide a direct incentive for small businesses to keep workers on the payroll. The PPP is a forgivable loan available for small businesses, 501(c)3, 501(c)19, and tribal businesses that meet the SBA small business designation, along with sole proprietors and independent contractors. Companies must have been operational by 02/15/2020. Other restrictions apply.

- Loan is equal to 250% average monthly payroll

- $10M maximum funding amount

- Funds spent on qualifying expenses over 24 weeks, or December 31, 2020 (whichever is earlier) can be forgiven

- Unspent amount rolls over into a low interest loan.

Note: Applications closed on 08/08/2020.

Eligibility Criteria

Borrowers do not need to demonstrate economic hardship but rather certify in good faith that their business has been affected by the current economic crisis. The organization must have been operational by 02/15/2020 to qualify.

Borrowers apply through banks certified in SBA 7(a) lending. Applicants must submit a Paycheck Protection Program Application form and recent tax documents.

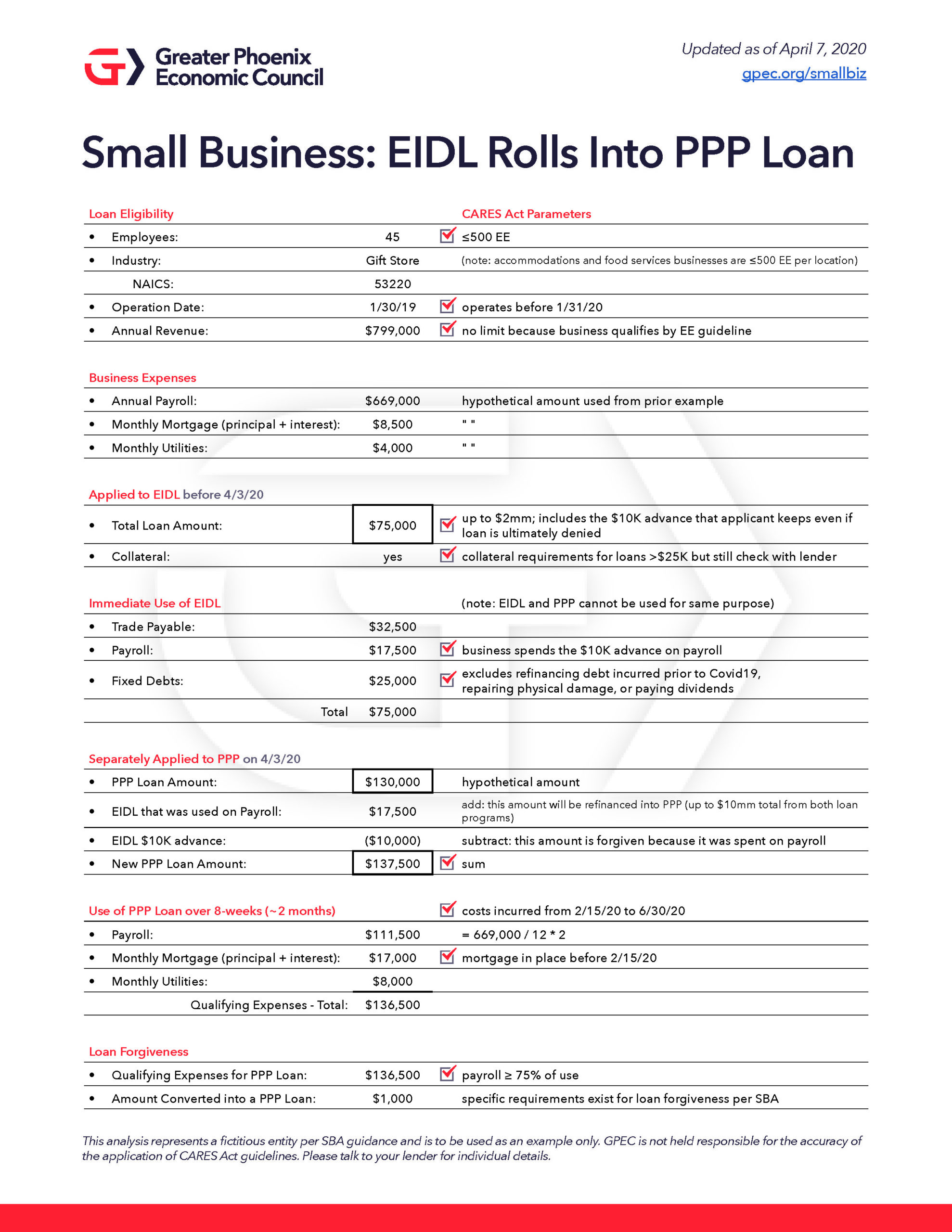

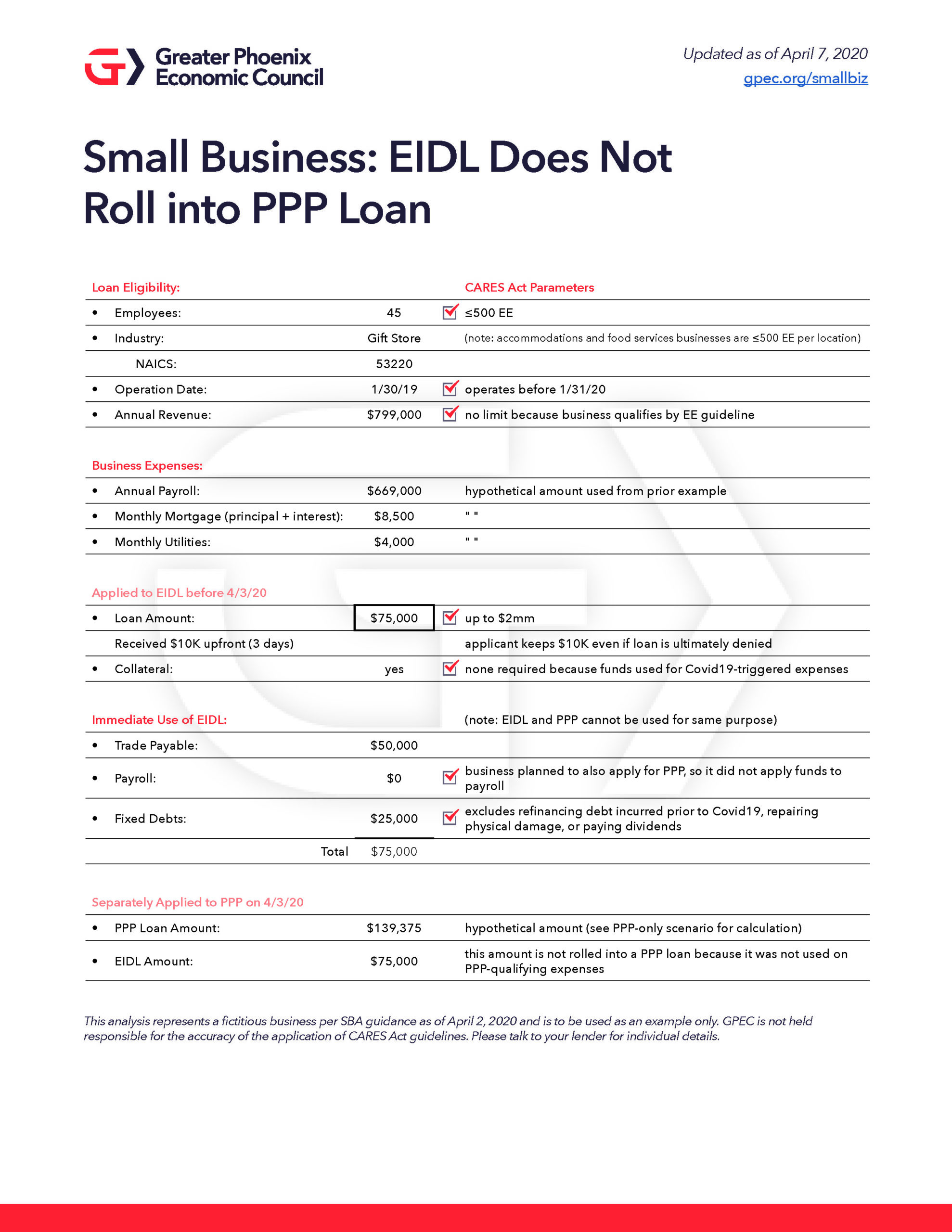

Sample Calculations and Scenarios

View the sample scenarios below for an illustration of the calculations and criteria requirements needed for a small business, nonprofit or sole proprietor applying for the paycheck protection program.

Small Business Application for PPP >>

Small Business Rolls EIDL into PPP >>

Small Business Applies EIDL & PPP Separately >>

Where to Apply

Applications are closed as of August 8, 2020.

Resources for Navigating the Application Process

Program overview, eligibility criteria, application processes, loan details and forgiveness, and other assistance can be found on the websites below.

Guidelines for PPP Loan Forgiveness

To ensure your business qualifies for loan forgiveness, loan requirements must be followed, otherwise the amount forgiven is reduced proportionally. Download the forgiveness application guide (EZ version) for additional information on the application process.

Some guidance around loan forgiveness is pending SBA release. Resources provided on this page will be updated when further information is received.

Review Federal Updates

President Trump signed the Paycheck Protection Program (PPP) Flexibility Act into law on June 5. The bill updates several of the PPP terms:

- Extends the timeframe allotted to use funds from eight weeks to 24-weeks

- Borrowers who received loans prior to June 5 may use either option

- Anyone who received a loan after June 5 has up to 24 weeks

- Allows businesses to use up to 40% of funds on non-payroll costs (previously 25%)

- Salary and/or FTE replacement date has been extended from June 30 to December 31, or when the forgiveness application is filed

- Businesses are now able to qualify for loan forgiveness based on decreased business activity due to COVID-19-related restrictions (e.g., social distancing)

- Allows businesses to qualify for partial loan forgiveness if less than 60% is spent on payroll costs

- Loans made after June 5 now have five years to be repaid instead of two (loans made on June 5 or earlier can also extend maturity dates upon approval by lender)

- Allows businesses to take advantage of the payroll tax deferment that was in the CARES act

- 1% interest rate on the loans remains the same

Review Loan Requirements

- 60% of the loan must be spent on payroll, which includes wages, salaries, healthcare premiums, vacation and sick pay, and local and state payroll taxes. The remaining 40% of the loan can be spent on rent, mortgage interest and utility payments.

- The average monthly full-time equivalent (FTE) headcount over the loan period must remain the same or higher than the average FTE headcount between February 15, 2019 and June 30, 2019 or January 1, 2020 to February 29, 2020.

- Wages under $100,000 cannot be reduced by more than 25%. Wages over $100,000 may be reduced to $100,000 and then no more than an additional 25%.

- Any headcount or wage reductions will not reduce loan forgiveness if the reductions are restored by December 31, 2020.

Additional Tips

- Keep detailed records showing how and when the Paycheck Protection Program loan amount was spent. Many banks have suggested a separate deposit account for the funds

- Loan recipients must apply for forgiveness with their lender at the end of the loan period

- The SBA has released three Paycheck Protection Program loan forgiveness applications

- PPP Loan Forgiveness Application, Standard

- Get helpful tips to navigate this forgiveness application: Download our guide here (pdf)

- PPP Loan Forgiveness Application, EZ

- View our guide for help navigating this forgiveness application: Download our EZ guide here (pdf)

- PPP Loan Forgiveness Application, Standard

-

- PPP Loan Forgiveness Application, S

- Available for borrowers that received a PPP loan of $50,000 or less. Instructions can be found here

- PPP Loan Forgiveness Application, S

Note: Any amount not forgiven will convert into a five-year loan, at a 1% interest rate.

Economic Injury Disaster Loans (EIDL)

Covers a wide range of business expenses for funds lost.

Also known as the “SBA Disaster Loan,” the EIDL is an extension of the existing disaster loan program. Businesses may apply for both EIDL and PPP, although funds cannot be used for the same purpose.

- $2M maximum funding amount

- 3.75% interest rate

- $10,000 advance can be obtained within 3 days *repayment not required on advance amount

Eligibility Criteria

For full details, see the “Eligibility Entity Verification” on the application.

- Applicant is a business with no more than 500 employees, a business that qualifies as small under the SBA Size Standards, sole proprietorship, independent contractor, cooperative or non-profit.

Sample Calculations and Scenarios

View the sample scenarios below for an illustration of the calculations and criteria needed as a small business, when applying for an Economic Injury Disaster Loan.

Where to Apply

Applications are currently open. Apply through the SBA Disaster Loan application. You may also apply for the Express Bridge Loan (EBL) program if you would like to expedite your potential EIDL financing.

Resources for Navigating the Process

Choose from a video guide, step-by-step written guide or contact resources at our local Arizona, SBA District Office for help with the application process. Arizona’s local SBA office can be reached at 602.745.7200, although due to high call volumes, we recommend exhausting online resources prior to calling.

Contact the SBA

P: 1-800-659-2955 (TTY: 1-800-877-8339)

E: DisasterCustomerService@sba.gov

How-To Video Guide – SBA Disaster Loan

by the City of Phoenix

Small Business Debt Relief Program

Covers non-disaster, business loan payments for six months including principle, interest and fees.

- Forgives current loan payments

- Available to new borrowers

- 7(a), 504 & microloans eligible

7(a) Loans

- $2M maximum funding amount

- SBA guaranteed up to 75%

Eligibility Overview

- Eligible loans include 7(a), 405 & Microloans

- Loans under the Paycheck Protection Act are NOT eligible

- New borrowers who take out loans within six months of the bill being signed can utilize this program

Where to Apply

Speak to your current financial provider to apply this assistance to your active business loan. Once requested, funds should quickly be applied.

Resources for Navigating the Process

Check the SBA guidelines and then speak to your business lender.

Taxes: Deferment or Credit

Two programs are available to reduce immediate tax costs: the Payroll Tax Deferment program and the Employee Retention Credit.

Payroll Tax Deferment program

- Defer your share of business Social Security taxes until 2022

- Funds must be paid back

- 50% of the deferral must be paid by 12/2021, with the remaining 50% paid by 12/2022

Employee Retention Credit

- Refundable Tax Credit equal to 50% of qualified wages

- Max credit per employee: $5,000

Eligibility Overview

- Employers of all sizes are eligible

- Businesses and sole proprietorships qualify

- Payroll taxes can be deferred until July 15, 2020

Where to Apply

Refer to your financial team on changes in the payroll process. All penalties for social security tax non-payment when filing weekly or biweekly payments will be waived. Visit the U.S. Treasury statement for more information on tax deferment. See tax relief program details on the IRS website.

Resources for Navigating the Process

Find resources on the IRS and U.S. Treasury websites.

Local Funds & Additional Resources

Groups in Arizona and businesses across the U.S. are developing funds to offer relief to businesses impacted by COVID-19.

Surprise Small Business Relief Grants

The City of Surprise announced a small business relief program to address the needs of the Surprise small business community impacted by the prolonged nature of the pandemic. Applications are expected to open on September 14, 2020.

AZ Community Foundation Relief Grant

The Phoenix IDA and City of Phoenix are offering grants up to $10,000 to local small businesses experiencing economic distress and sudden loss of revenue. Find qualifications and apply below.

Relief Fund for AZ Arts Professionals

A collaborative fund for emergency support for working artists, teaching artists, production personnel, and arts-based contract workers who have experienced cancelled events and residencies or terminated contracts as a result of the global COVID-19 pandemic crisis.

Phoenix Small Business Relief Grants

The Phoenix IDA, in coordination with the City of Phoenix and a growing list of funders, are offering grants up to $10,000 to local small businesses experiencing economic distress and sudden loss of revenue due to the COVID-19 pandemic.

Salesforce Small Business Grant Program

Salesforce partnered with Ureeka to provide Arizona small businesses the opportunity to receive $10,000 in grant funds. See the full details below.

Facebook Small Business Grants Program

Facebook is offering $100M in cash grants and ad credits for up to 30,000 eligible small businesses. Stay tuned to their website for updates and to get access to additional business resources.

Building a business as a Latino entrepreneur

Bankrate has produced this guide to help fellow Latino entrepreneurs, sharing personal experiences from Latino business owners, and detailing how to get started launching your own business.

Local Banking Contacts

For assistance with your current business account, please contact the recommended resource listed for your bank.

We are working with local banks to acquire a designated business account contact from each financial institution. Updated contact information will be listed as soon as it is provided to us.

NOTE: Banks are prioritizing existing clients, contact your current bank representative first.

View the full list of local lending contacts, last updated 04/25/20 here:

Academy Bank

Lisa Dow

SVP, Director of Commercial Banking, English

E: ldow@academybank.com

P: 480.482.4724

BOK Financial

Brian Barry

SVP Commercial Banking, English

E: bbarry@bokf.com

P: 480.459.2829

Elias Espinoza

VP Commercial Banker, Spanish

E: eespinoza@bokf.com

P: 602.217.1596

BBVA

Steve Gation

SBA Loan Officer, Vice President, English

E: steven.gation@bbva.com

P: 602.522.2696

Desert Financial Credit Union

Dedicated Experts

Customer Support

E: paycheckprotectionprogram@desertfinancial.com

P: 602.335.2359

MidFirst Bank

Thomas J. Altieri

SVP, SBA Lending Manager, English

E: tom.altieri@midfirst.com

P: 602.801.5713

National Bank of Arizona

John Lewis

SBA Banker, English

E: john.lewis@nbarizona.com

P: 602.212.5545

Marcos Garay

EVP, Director of Multicultural Banking, Spanish

E: marcos.garay@nbarizona.com

P: 602.212.5543

Enterprise Bank

Kelli Tonkin

Senior Vice President, English

P: 602.824.5719

First International Bank & Trust

Sue Hayes

Wealth Advisor, English

E: shayes@fibt.com

P: 480.318.8855

C: 602.396.1160

First Western Trust

Phoenix Location

Visit Phoenix Contact Page

E: phoenixbanking@myfw.com

P: 602.224.7600

Scottsdale Location

Visit Scottsdale Contact Page

E: scottsdalebanking@myfw.com

P: 480.596-1800

UMB Bank

Sean Scibienski

SVP Team Lead | Business Banking, English

E: sean.scibienski@umb.com

P: 602.912.6742

Cyeana Johnson

BB Relationship Officer II, Spanish

E: cyeana.johnson@umb.com

P: 520.273.4997

US Bank

Ray St Clair

SBA Lender, English

E: ray.stclair@usbank.com

P: 602.980.3030

Phil Hicks

SBA Lender, Spanish

E: phil.hicks@usbanks.com

P: 602.222.4588

Wells Fargo

Wells Fargo bank is now reviewing applications for the Paycheck Protection Program, focusing on nonprofits and small businesses with fewer than 50 employees.