Things to know about Arizona’s FinTech Sandbox

Published: 04/08/2021

Updated: 10/07/2021

Arizona enacted groundbreaking regulatory FinTech Sandbox

Updated: 4/8/21

In March 2018, Arizona became the first state in the country to enact a groundbreaking regulatory FinTech Sandbox. Arizona joined countries such as the United Kingdom, Singapore, United Arab Emirates and Australia in encouraging financial technology investment by instituting sandboxes.

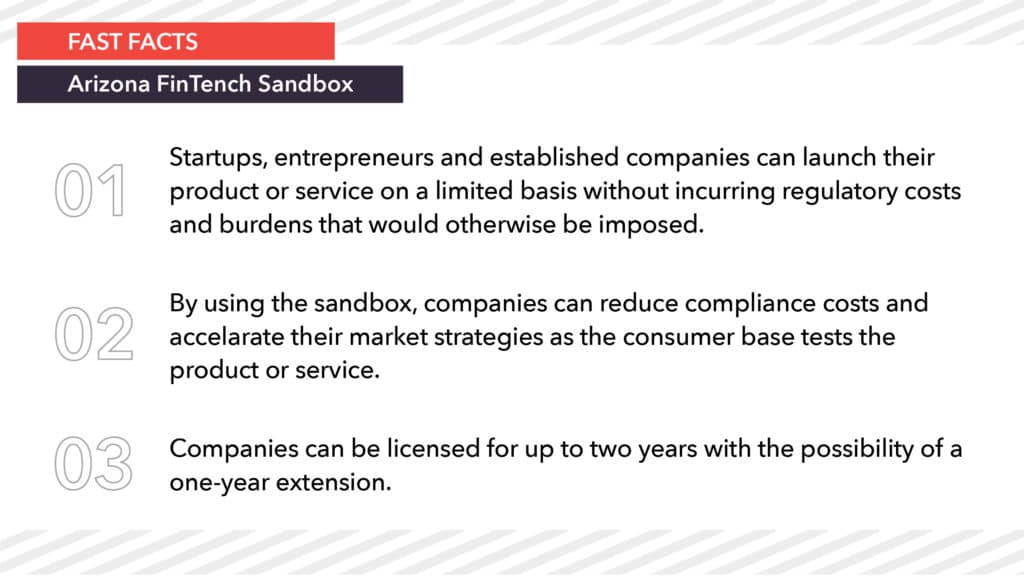

With the Arizona FinTech Sandbox, startups, entrepreneurs and established companies are allowed to launch products on a limited, temporary scale for consumers to test the software before it is opened to the market. Companies can do so without incurring regulatory costs or burdens.

In forming this sandbox, the state hoped to stimulate and expedite innovation by removing barriers while allowing the the office of Arizona Attorney General Mark Brnovich to oversee the industry.

In the three years since its creation, the program has expanded. Gov. Doug Ducey created another Arizona regulatory sandbox in 2019, this one specifically for Arizona property technology companies.

In February 2021, the Arizona Fintech Council was formed by a group of partners that included the Arizona Bankers Association, CCG Catalyst Consulting, the Arizona Technology Council and Arizona State University. They will work to help companies and financial institutions connect.

Learn more about the sandbox, eligibility requirements and how we can help you with the application.

What exactly is a Fintech Sandbox?

- Arizona companies can develop, test, and deploy innovative products without licensure or authorization for up to two years, with a possibility of a one-year extension.

- Fintech startups and other companies that participate can reduce compliance costs and accelerate their go-to-market strategies.

What is the application process?

- To apply, sandbox participants must fill out a form to provide information about their service or product to the Attorney General’s Office.

- The application fee is $500.

- After approval, sandbox users will have 24 months to test their product or service.

- A sandbox participant may request an extension of up to one year from the Attorney General’s Office.

Who heads Arizona’s sandbox?

- The Office of the Attorney General is responsible for approving and providing entry of applicants into the sandbox.

- The civil division of the office will administer the sandbox program.

- The Arizona Consumer Fraud Act guides all products and services offered in the sandbox. All products must comply with all statutory limits and caps in Arizona law related to financial transactions.

What are eligibility requirements?

- The company must be under the jurisdiction of the AG through incorporation, residency, or presence agreement.

- It must operate and maintain records and date in a physical or virtual location that is accessible to the attorney general.

- Consumers must be Arizona residents.

- The user base for a fintech product is capped at 10,000 customers. This may be increased to 17,500 if the company is financially solvent and has proper risk management protocols in place.

- There is a cap on the maximum loan size.

- The program ends on July 1, 2028.

For more background on the sandbox and financial technology:

- Read about the fintech companies choosing Greater Phoenix

- Q&A with Arizona Attorney General Mark Brnovich