Accelerate your biosciences operations in the emerging Greater Phoenix hub

Backed by a long legacy of high-quality healthcare services and manufacturing, innovative bioscience companies are choosing Greater Phoenix as a home to scale and accelerate their businesses with support from educational partners and a growing workforce. Explore the collaborative clusters and advantageous operating environments offered in the region.

Biosciences Industry Report

Get our 42-page, in-depth report on the biosciences ecosystem in Greater Phoenix.

Cutting-Edge Research

A Region of Innovation

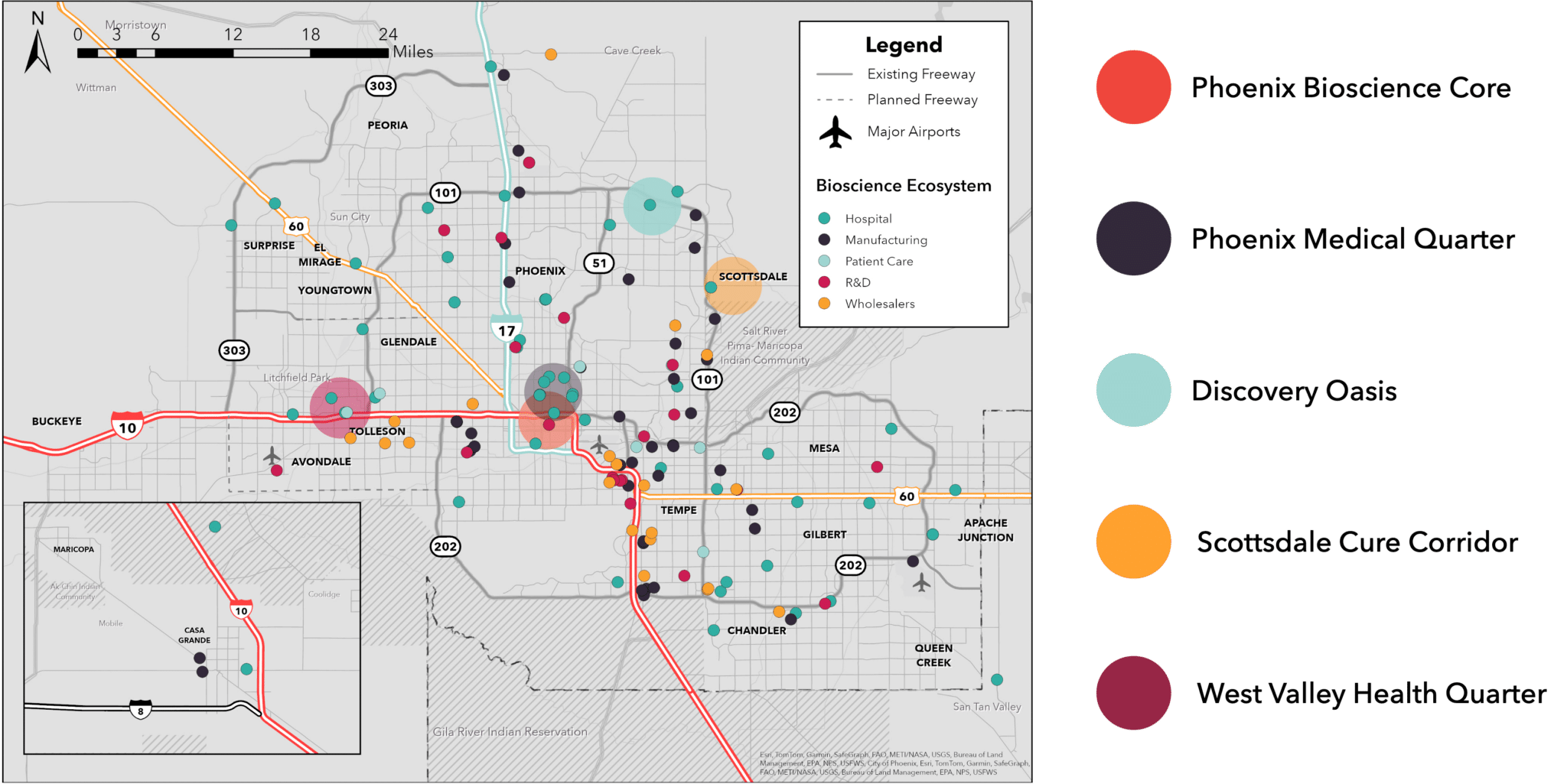

Five bioscience and healthcare hubs throughout the region drive research, development and innovation of the life sciences throughout Greater Phoenix. These clusters allow companies, schools, government agencies, hospitals and nonprofits to work in close quarters to maximize opportunities for growth and collaborative efforts with industry leaders.

Explore the locations on the map and get more information on each cluster below.

Phoenix Bioscience Core

Located in downtown Phoenix, the Phoenix Bioscience Core (PBC) is a 30-acre urban medical and bioscience campus that serves as a premier and dynamic environment for research activities. It is a collection of Arizona’s three major universities, three of the five major hospital systems that operate in the region, and a mixture of public and private research clustered in the same neighborhood in the heart of the capital. As of 2023, PBC consisted of 2 million square feet with plans to develop to more than 6 million square feet.

Here is a sample of the industry’s presence inside the core:

Other bioscience corridors in Greater Phoenix include:

Discovery Oasis

A 120-acre medical and research campus with 3.3 million square feet of facilities adjacent to the Mayo Clinic campus, the Discovery Oasis site plan incorporates research facilities, offices and site amenities including Class A space, wet and dry labs, and biomanufacturing facilities. It is also home to the 150,000-square-foot ASU Health Futures Center and the Mayo-ASU MedTech Accelerator.

Photo credit: Discovery Oasis

Phoenix Medical Quarter

This bio-innovation district in midtown Phoenix is anchored by Creighton University, Barrow Neurological Institute (BNI) and Phoenix Children’s Hospital. A key space for the influx of healthcare, biosciences and biomedical education in the area, it also houses the WearTech Applied Research Center, RadNet Imaging Center, BNI’s Barrow Neuroplex and the Ivy Tumor Brain Center global headquarters.

Scottsdale Cure Corridor (SCC)

The SCC, a healthcare and bio-life science industry corridor, runs from the Scottsdale Airpark to SkySong Innovation Center and is home to a variety of businesses including education, research, clinical trials and patient care delivery. Target industries include pharmaceuticals, other biological products, medical laboratories and biotech research, as the clustering helps connect clinical trials with healthcare providers.

Photo credit: SkySong

West Valley Health Quarter

This Avondale health center is an eight-square-mile center consisting of over 65 healthcare-related companies. Operations in this cluster include Copper Springs Hospital, the Phoenix Children’s Southwest Specialty and Urgent Care Center, the Arizona Center for Cancer Care, and Cancer Treatment Centers of America.

Photo credit: Avondale EDGE

University Alignment

Connecting Education and Industry

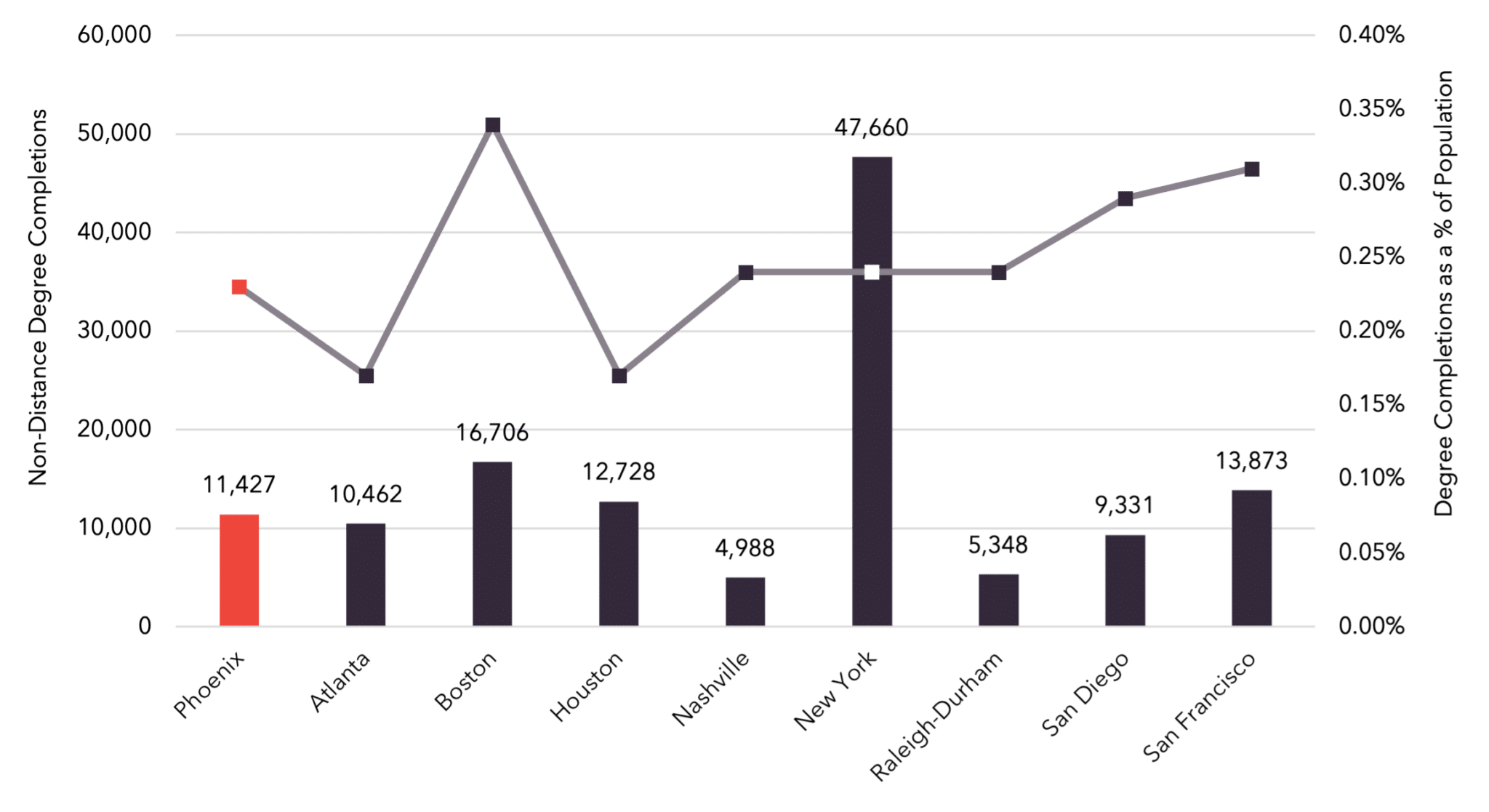

Arizona State University (ASU) and University of Arizona (U of A) play proactive roles in the research and development of bioscience at educational institutions and in operating hubs around the region. These universities, as well as the 10 schools in the Maricopa County Community College District (MCCCD), drive a regional student population in healthcare and bioscience fields to higher enrollment than competitor regions like Atlanta, San Diego and Raleigh-Durham.

Greater Phoenix institutions awarded more than 5,000 certificates, 3,100 bachelor degrees, and 1,300 master’s and doctorate’s degrees in 2022.

Competitor Markets’ Talent Pipeline

Arizona State University

ASU’s 350,000-square-foot Biodesign Institute consists of more than 15 research centers designed for those researching biomedicine, health outcomes, sustainability and security. The university’s School of Life Sciences has nine undergraduate programs and 20 graduate programs, while the College of Integrative Sciences and Arts provides field and lab work to prepare students for careers in biology and related sciences.

University of Arizona

U of A, which has a medical school in Phoenix, is developing its Center for Advanced Molecular and Immunological Therapies (CAMI) at the PBC in downtown Phoenix. This national biomedical research hub seeks to develop strategies for the diagnosis, prevention and treatment of diseases while unraveling the complexities of immunology.

Maricopa County Community Colleges District

MCCCD, one of the largest community college systems in the nation, offers programs including its Associate in Applied Science in Biotechnology and Molecular Biosciences at Glendale Community College. The district is involved in regional cooperations including the consortium that is part of the EDA’s Tech Hubs program.

#1

ASU ranks No. 1 in the U.S. in innovation, sustainability and global impact

Source: U.S. News & World Report

$156.2M

Schools in the U of A Health Sciences program received a combined $156.2M in NIH funding

Source: U of Health Sciences Office of Communications

168000

MCCCD serves 168,000 students at its 10 campuses around Greater Phoenix and online

Exceptional Talent Pipeline

A Dedicated Workforce

In addition to the 11,000+ degrees rewarded annually in the region, Greater Phoenix has a substantial workforce that has grown by more than 50% since 2018. With more than 140,000 employees in related occupations, the region has a larger and faster-growing biosciences talent pool than Nashville, Raleigh-Durham and San Diego. Below are a handful of sample occupations compared across major metros; view the full report for a comprehensive overview.

Occupation

Phoenix

Atlanta

Boston

Houston

Nashville

New York

Raleigh-Durham

San Diego

San Francisco

Clinical Laboratory Technologists and Technicians

6,908

6,459

9,929

8,190

3,220

19,734

3,909

2,966

4,724

Chemical Equipment Operators and Tenders

1,120

1,896

1,305

6,231

726

8,127

948

561

726

Biological Technicians

830

561

6,089

2,002

773

3,387

1,952

2,741

4,071

Chemists

561

710

3,604

1,756

149

7,661

2,374

1,593

2,530

Chemical Technicians

336

495

1,556

3,122

228

3,330

480

914

1,205

Bioengineers and Biomedical Engineers

310

171

2,360

252

41

832

429

492

679

Biological Scientists, All Other

276

1,147

2,562

578

239

1,774

2,594

3,571

6,060

Biochemists and Biophysicists

145

86

9,787

73

38

398

1,462

2,705

726

% Change (2018-2023)

54.6%

33.8%

26.5%

59.6%

53.6%

30.1%

34.0%

21.2%

29.9%

67%

STEM completion growth in Greater Phoenix from 2012-22

Source: Lightcast 2024 Q1 Dataset

3000

New bioscience jobs in city of Phoenix from 2018-23

Source: City of Phoenix

$364M

NIH funding across Arizona 2023

Source: City of Phoenix

Download the full industry analysis to learn more about the biosciences ecosystem labor pool.

Nationally Recognized Research Institutes

The Companies Driving Life Sciences Growth

The rapid growth in the Greater Phoenix biosciences ecosystem has positioned the region as an emerging industry hub. Cutting-edge research in precision medicine, neurosciences, biomarker identification and immunotherapies is advanced through strong core capabilities in translational genomics, medical device manufacturing, diagnostic development and clinical trials activity. Examples of leading companies in the region include:

Biopharmaceutical manufacturing

Diagnostic and prognostic clinical operations

Neurodegenerative disease diagnosis

Cancer Diagnostic Development

Oncology contract research

Blood and specimen processing

Translational Genomics Research Institute (TGen)

TGen, an affiliate of City of Hope, is a Phoenix-based nonprofit medical institute researching solutions for genetic components of common and complex diseases including cancer, neurological disorders, infectious disease and rare childhood disorders. Over the last decade, its sequencing accuracy to detect early signs of cancer has improved 100-fold while cost per-patient dropped at the same rate.

With hundreds of partnerships around the world and nearly 20 spinout companies, it plays a pivotal role as a member of the PBC and Greater Phoenix community.

Startups

Greater Phoenix has been one of the most successful regions in the nation at attracting venture capital, angel and seed funding in recent years, with more than $9 billion from 2018-23. The biosciences industry was the source of almost $400 million during that span.

Playing a role in the growth of the biosciences startup ecosystem is the Arizona Innovation Challenge, a business plan competition that awards $1.5 million annually to startups. In recent years, a number of winners have been healthcare and bioscience industry players that focus on areas including diagnostics, microscopy testing, EEG monitoring and brain injury monitoring.

Nonprofit Support

Greater Phoenix nonprofits are committed to supporting innovators in the space and furthering biosciences. The Flinn Foundation, a privately endowed, philanthropic grantmaking organization focused on education and the biosciences sector, commissioned the Arizona Bioscience Roadmap to outline Arizona’s goals within the industry over a 10-year period. AZBio supports the life science ecosystem with connections to Advanced Medical Technology Association the Biotechnology Innovation Organization and more.

In addition, renowned health institutions are among leaders in patient care, research and development, and employment in Arizona.

29,745 employees

9,461 employees

9,149 employees

8,786 employees

A Community Partnership

Together, many of these companies have partnered in a consortium that has received federal funding from the U.S. Economic Development Administration’s Tech Hubs program to drive medical device manufacturing. This 28-member consortium includes educational institutions like ASU, U of A and MCCCD; health institutions like the PBC, Dignity Health and Mayo Clinic; manufacturers like W.L. Gore and Intel; nonprofits including the Flinn Foundation, AZBio and the Greater Phoenix Economic Council; and more.

Learn more about the Greater Phoenix biosciences and life sciences industry.

Competitive Operating Costs

Companies in Greater Phoenix enjoy the benefits of low business costs, minimal regulation and an advantageous operating environment in a right-to-work state. From aggressive tax credits and incentive programs designed to increase access to capital, the Greater Phoenix region offers businesses a robust, pro-business climate.

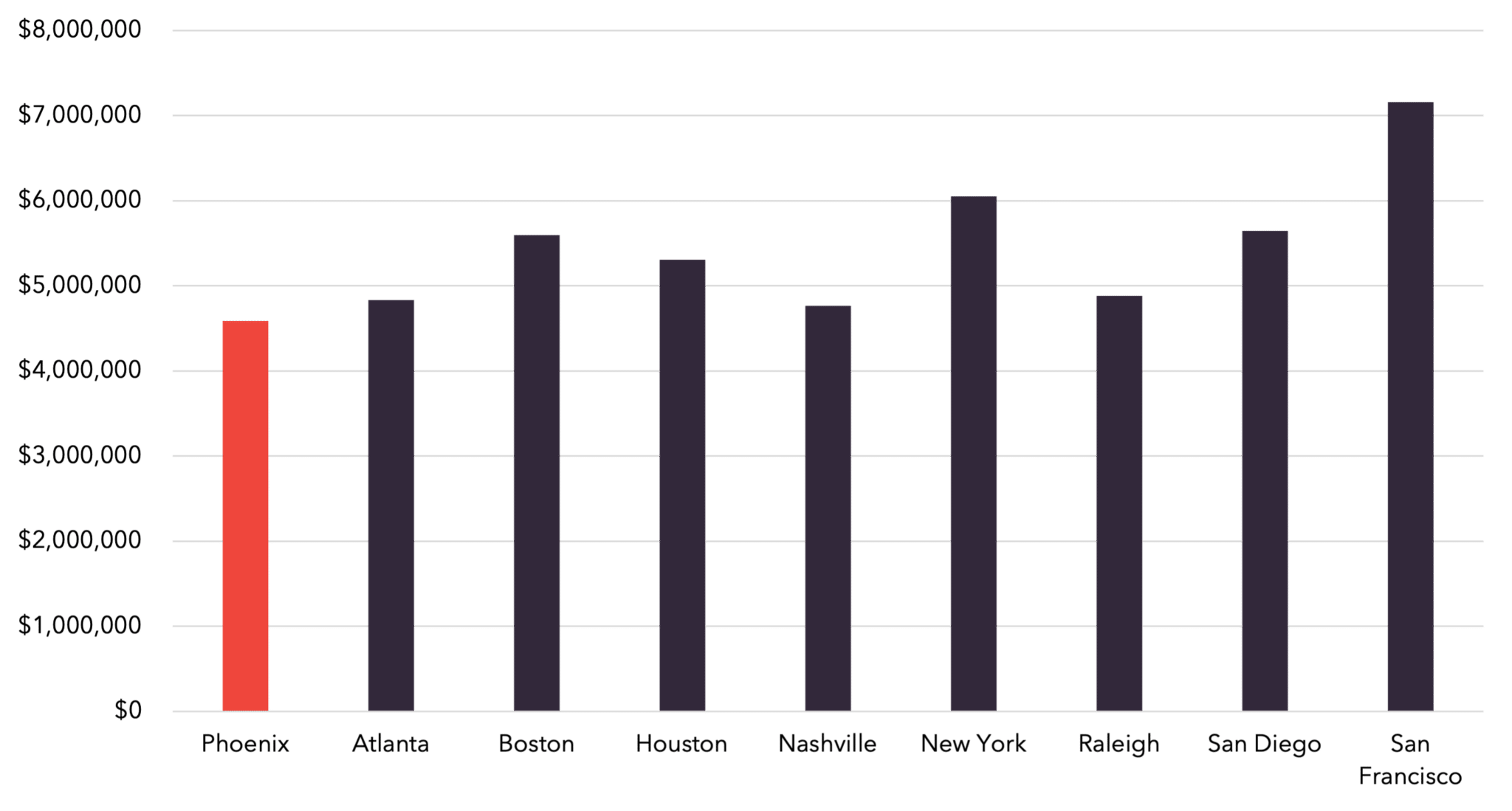

Annual Business Operating Cost Comparison

The Annual Business Operating Cost Pro-forma below estimates the cost of running a typical biosciences business in competitor markets across a handful of major expense categories. Component and custom analyses to match your company’s operations can be provided upon request. Contact us to request a custom analysis for your business.

Below, find a sample comparison of research and development operations. Download the use case for similar reports on back office and manufacturing for biosciences.

Metro

Employee Payroll

Fringe and Mandated Benefits

Real Estate Payments

Property Tax

Total Operating Cost

Index

Phoenix

$3,358,174

$741,046

$483,750

$2,299

$4,585,269

100.0%

Atlanta

$3,547,090

$795,433

$409,500

$79,940

$4,831,963

105.4%

Boston

$4,081,744

$915,965

$472,950

$123,400

$5,594,059

122.0%

Houston

$3,842,427

$846,925

$502,050

$113,243

$5,304,645

115.7%

Nashville

$3,374,202

$750,261

$590,700

$48,810

$4,763,973

103.9%

New York

$4,166,107

$956,989

$926,250

$0

$6,049,346

131.9%

Raleigh

$3,561,963

$800,115

$466,800

$50,625

$4,879,503

106.4%

San Diego

$3,853,436

$1,060,992

$669,600

$58,700

$5,642,728

123.1%

San Francisco

$4,597,853

$1,260,219

$1,207,800

$93,000

$7,158,872

156.1%

Regional Cost Comparison

Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 77 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in the vibrant arts and culture scene that includes everything from prominent classical arts and public art to craft markets and a diverse range of music and cultural events. Enjoy fresh farmers markets in every city, as well as globally recognized chefs and culinary experiences at your doorstep.

Calculate your savings

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Austin

Dallas

Denver

Los Angeles

Portland

San Francisco

Seattle

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Total Annual Savings

$

Source: C2ER 2024 Q1 Cost of Living Analysis; Zillow Research August 2024

A Region of Innovation

Five bioscience and healthcare hubs throughout the region drive research, development and innovation of the life sciences throughout Greater Phoenix. These clusters allow companies, schools, government agencies, hospitals and nonprofits to work in close quarters to maximize opportunities for growth and collaborative efforts with industry leaders.

Explore the locations on the map and get more information on each cluster below.

Phoenix Bioscience Core

Located in downtown Phoenix, the Phoenix Bioscience Core (PBC) is a 30-acre urban medical and bioscience campus that serves as a premier and dynamic environment for research activities. It is a collection of Arizona’s three major universities, three of the five major hospital systems that operate in the region, and a mixture of public and private research clustered in the same neighborhood in the heart of the capital. As of 2023, PBC consisted of 2 million square feet with plans to develop to more than 6 million square feet.

Here is a sample of the industry’s presence inside the core:

Other bioscience corridors in Greater Phoenix include:

Discovery Oasis

A 120-acre medical and research campus with 3.3 million square feet of facilities adjacent to the Mayo Clinic campus, the Discovery Oasis site plan incorporates research facilities, offices and site amenities including Class A space, wet and dry labs, and biomanufacturing facilities. It is also home to the 150,000-square-foot ASU Health Futures Center and the Mayo-ASU MedTech Accelerator.

Photo credit: Discovery Oasis

Phoenix Medical Quarter

This bio-innovation district in midtown Phoenix is anchored by Creighton University, Barrow Neurological Institute (BNI) and Phoenix Children’s Hospital. A key space for the influx of healthcare, biosciences and biomedical education in the area, it also houses the WearTech Applied Research Center, RadNet Imaging Center, BNI’s Barrow Neuroplex and the Ivy Tumor Brain Center global headquarters.

Scottsdale Cure Corridor (SCC)

The SCC, a healthcare and bio-life science industry corridor, runs from the Scottsdale Airpark to SkySong Innovation Center and is home to a variety of businesses including education, research, clinical trials and patient care delivery. Target industries include pharmaceuticals, other biological products, medical laboratories and biotech research, as the clustering helps connect clinical trials with healthcare providers.

Photo credit: SkySong

West Valley Health Quarter

This Avondale health center is an eight-square-mile center consisting of over 65 healthcare-related companies. Operations in this cluster include Copper Springs Hospital, the Phoenix Children’s Southwest Specialty and Urgent Care Center, the Arizona Center for Cancer Care, and Cancer Treatment Centers of America.

Photo credit: Avondale EDGE

University Alignment

Connecting Education and Industry

Arizona State University (ASU) and University of Arizona (U of A) play proactive roles in the research and development of bioscience at educational institutions and in operating hubs around the region. These universities, as well as the 10 schools in the Maricopa County Community College District (MCCCD), drive a regional student population in healthcare and bioscience fields to higher enrollment than competitor regions like Atlanta, San Diego and Raleigh-Durham.

Greater Phoenix institutions awarded more than 5,000 certificates, 3,100 bachelor degrees, and 1,300 master’s and doctorate’s degrees in 2022.

Competitor Markets’ Talent Pipeline

Arizona State University

ASU’s 350,000-square-foot Biodesign Institute consists of more than 15 research centers designed for those researching biomedicine, health outcomes, sustainability and security. The university’s School of Life Sciences has nine undergraduate programs and 20 graduate programs, while the College of Integrative Sciences and Arts provides field and lab work to prepare students for careers in biology and related sciences.

University of Arizona

U of A, which has a medical school in Phoenix, is developing its Center for Advanced Molecular and Immunological Therapies (CAMI) at the PBC in downtown Phoenix. This national biomedical research hub seeks to develop strategies for the diagnosis, prevention and treatment of diseases while unraveling the complexities of immunology.

Maricopa County Community Colleges District

MCCCD, one of the largest community college systems in the nation, offers programs including its Associate in Applied Science in Biotechnology and Molecular Biosciences at Glendale Community College. The district is involved in regional cooperations including the consortium that is part of the EDA’s Tech Hubs program.

#1

ASU ranks No. 1 in the U.S. in innovation, sustainability and global impact

Source: U.S. News & World Report

$156.2M

Schools in the U of A Health Sciences program received a combined $156.2M in NIH funding

Source: U of Health Sciences Office of Communications

168000

MCCCD serves 168,000 students at its 10 campuses around Greater Phoenix and online

Exceptional Talent Pipeline

A Dedicated Workforce

In addition to the 11,000+ degrees rewarded annually in the region, Greater Phoenix has a substantial workforce that has grown by more than 50% since 2018. With more than 140,000 employees in related occupations, the region has a larger and faster-growing biosciences talent pool than Nashville, Raleigh-Durham and San Diego. Below are a handful of sample occupations compared across major metros; view the full report for a comprehensive overview.

| Occupation | Phoenix | Atlanta | Boston | Houston | Nashville | New York | Raleigh-Durham | San Diego | San Francisco |

|---|---|---|---|---|---|---|---|---|---|

Clinical Laboratory Technologists and Technicians |

6,908 |

6,459 |

9,929 |

8,190 |

3,220 |

19,734 |

3,909 |

2,966 |

4,724 |

Chemical Equipment Operators and Tenders |

1,120 |

1,896 |

1,305 |

6,231 |

726 |

8,127 |

948 |

561 |

726 |

Biological Technicians |

830 |

561 |

6,089 |

2,002 |

773 |

3,387 |

1,952 |

2,741 |

4,071 |

Chemists |

561 |

710 |

3,604 |

1,756 |

149 |

7,661 |

2,374 |

1,593 |

2,530 |

Chemical Technicians |

336 |

495 |

1,556 |

3,122 |

228 |

3,330 |

480 |

914 |

1,205 |

Bioengineers and Biomedical Engineers |

310 |

171 |

2,360 |

252 |

41 |

832 |

429 |

492 |

679 |

Biological Scientists, All Other |

276 |

1,147 |

2,562 |

578 |

239 |

1,774 |

2,594 |

3,571 |

6,060 |

Biochemists and Biophysicists |

145 |

86 |

9,787 |

73 |

38 |

398 |

1,462 |

2,705 |

726 |

% Change (2018-2023) |

54.6% |

33.8% |

26.5% |

59.6% |

53.6% |

30.1% |

34.0% |

21.2% |

29.9% |

67%

STEM completion growth in Greater Phoenix from 2012-22

Source: Lightcast 2024 Q1 Dataset

3000

New bioscience jobs in city of Phoenix from 2018-23

Source: City of Phoenix

$364M

NIH funding across Arizona 2023

Source: City of Phoenix

Download the full industry analysis to learn more about the biosciences ecosystem labor pool.

Nationally Recognized Research Institutes

The Companies Driving Life Sciences Growth

The rapid growth in the Greater Phoenix biosciences ecosystem has positioned the region as an emerging industry hub. Cutting-edge research in precision medicine, neurosciences, biomarker identification and immunotherapies is advanced through strong core capabilities in translational genomics, medical device manufacturing, diagnostic development and clinical trials activity. Examples of leading companies in the region include:

Biopharmaceutical manufacturing

Diagnostic and prognostic clinical operations

Neurodegenerative disease diagnosis

Cancer Diagnostic Development

Oncology contract research

Blood and specimen processing

Translational Genomics Research Institute (TGen)

TGen, an affiliate of City of Hope, is a Phoenix-based nonprofit medical institute researching solutions for genetic components of common and complex diseases including cancer, neurological disorders, infectious disease and rare childhood disorders. Over the last decade, its sequencing accuracy to detect early signs of cancer has improved 100-fold while cost per-patient dropped at the same rate.

With hundreds of partnerships around the world and nearly 20 spinout companies, it plays a pivotal role as a member of the PBC and Greater Phoenix community.

Startups

Greater Phoenix has been one of the most successful regions in the nation at attracting venture capital, angel and seed funding in recent years, with more than $9 billion from 2018-23. The biosciences industry was the source of almost $400 million during that span.

Playing a role in the growth of the biosciences startup ecosystem is the Arizona Innovation Challenge, a business plan competition that awards $1.5 million annually to startups. In recent years, a number of winners have been healthcare and bioscience industry players that focus on areas including diagnostics, microscopy testing, EEG monitoring and brain injury monitoring.

Nonprofit Support

Greater Phoenix nonprofits are committed to supporting innovators in the space and furthering biosciences. The Flinn Foundation, a privately endowed, philanthropic grantmaking organization focused on education and the biosciences sector, commissioned the Arizona Bioscience Roadmap to outline Arizona’s goals within the industry over a 10-year period. AZBio supports the life science ecosystem with connections to Advanced Medical Technology Association the Biotechnology Innovation Organization and more.

In addition, renowned health institutions are among leaders in patient care, research and development, and employment in Arizona.

29,745 employees

9,461 employees

9,149 employees

8,786 employees

A Community Partnership

Together, many of these companies have partnered in a consortium that has received federal funding from the U.S. Economic Development Administration’s Tech Hubs program to drive medical device manufacturing. This 28-member consortium includes educational institutions like ASU, U of A and MCCCD; health institutions like the PBC, Dignity Health and Mayo Clinic; manufacturers like W.L. Gore and Intel; nonprofits including the Flinn Foundation, AZBio and the Greater Phoenix Economic Council; and more.

Learn more about the Greater Phoenix biosciences and life sciences industry.

Competitive Operating Costs

Companies in Greater Phoenix enjoy the benefits of low business costs, minimal regulation and an advantageous operating environment in a right-to-work state. From aggressive tax credits and incentive programs designed to increase access to capital, the Greater Phoenix region offers businesses a robust, pro-business climate.

Annual Business Operating Cost Comparison

The Annual Business Operating Cost Pro-forma below estimates the cost of running a typical biosciences business in competitor markets across a handful of major expense categories. Component and custom analyses to match your company’s operations can be provided upon request. Contact us to request a custom analysis for your business.

Below, find a sample comparison of research and development operations. Download the use case for similar reports on back office and manufacturing for biosciences.

Metro

Employee Payroll

Fringe and Mandated Benefits

Real Estate Payments

Property Tax

Total Operating Cost

Index

Phoenix

$3,358,174

$741,046

$483,750

$2,299

$4,585,269

100.0%

Atlanta

$3,547,090

$795,433

$409,500

$79,940

$4,831,963

105.4%

Boston

$4,081,744

$915,965

$472,950

$123,400

$5,594,059

122.0%

Houston

$3,842,427

$846,925

$502,050

$113,243

$5,304,645

115.7%

Nashville

$3,374,202

$750,261

$590,700

$48,810

$4,763,973

103.9%

New York

$4,166,107

$956,989

$926,250

$0

$6,049,346

131.9%

Raleigh

$3,561,963

$800,115

$466,800

$50,625

$4,879,503

106.4%

San Diego

$3,853,436

$1,060,992

$669,600

$58,700

$5,642,728

123.1%

San Francisco

$4,597,853

$1,260,219

$1,207,800

$93,000

$7,158,872

156.1%

Regional Cost Comparison

Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 77 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in the vibrant arts and culture scene that includes everything from prominent classical arts and public art to craft markets and a diverse range of music and cultural events. Enjoy fresh farmers markets in every city, as well as globally recognized chefs and culinary experiences at your doorstep.

Calculate your savings

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Austin

Dallas

Denver

Los Angeles

Portland

San Francisco

Seattle

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Total Annual Savings

$

Source: C2ER 2024 Q1 Cost of Living Analysis; Zillow Research August 2024

Companies in Greater Phoenix enjoy the benefits of low business costs, minimal regulation and an advantageous operating environment in a right-to-work state. From aggressive tax credits and incentive programs designed to increase access to capital, the Greater Phoenix region offers businesses a robust, pro-business climate.

Annual Business Operating Cost Comparison

The Annual Business Operating Cost Pro-forma below estimates the cost of running a typical biosciences business in competitor markets across a handful of major expense categories. Component and custom analyses to match your company’s operations can be provided upon request. Contact us to request a custom analysis for your business.

Below, find a sample comparison of research and development operations. Download the use case for similar reports on back office and manufacturing for biosciences.

| Metro | Employee Payroll | Fringe and Mandated Benefits | Real Estate Payments | Property Tax | Total Operating Cost | Index |

|---|---|---|---|---|---|---|

Phoenix |

$3,358,174 |

$741,046 |

$483,750 |

$2,299 |

$4,585,269 |

100.0% |

Atlanta |

$3,547,090 |

$795,433 |

$409,500 |

$79,940 |

$4,831,963 |

105.4% |

Boston |

$4,081,744 |

$915,965 |

$472,950 |

$123,400 |

$5,594,059 |

122.0% |

Houston |

$3,842,427 |

$846,925 |

$502,050 |

$113,243 |

$5,304,645 |

115.7% |

Nashville |

$3,374,202 |

$750,261 |

$590,700 |

$48,810 |

$4,763,973 |

103.9% |

New York |

$4,166,107 |

$956,989 |

$926,250 |

$0 |

$6,049,346 |

131.9% |

Raleigh |

$3,561,963 |

$800,115 |

$466,800 |

$50,625 |

$4,879,503 |

106.4% |

San Diego |

$3,853,436 |

$1,060,992 |

$669,600 |

$58,700 |

$5,642,728 |

123.1% |

San Francisco |

$4,597,853 |

$1,260,219 |

$1,207,800 |

$93,000 |

$7,158,872 |

156.1% |

Regional Cost Comparison

Quality of Life

Experience a vibrant lifestyle and diverse culture at an affordable cost of living.

Enjoy the outdoors with more than 300 days of sunshine, average temperatures of 77 degrees, convenient access to over 400 hiking trails and globally recognized sporting events. Take part in the vibrant arts and culture scene that includes everything from prominent classical arts and public art to craft markets and a diverse range of music and cultural events. Enjoy fresh farmers markets in every city, as well as globally recognized chefs and culinary experiences at your doorstep.

Calculate your savings

Select your annual income, monthly mortgage, healthcare and grocery costs to find how much you would save with a move to Greater Phoenix.

Annual Income

Monthly Mortgage

Monthly Healthcare

Monthly Groceries

Source: C2ER 2024 Q1 Cost of Living Analysis; Zillow Research August 2024