Regional Report: The Future of Mining in Arizona

Published: 07/03/2024

Non-fuel minerals production will play a key role in the electrification of the economy

For centuries, mining has been a central part of the Arizona economy. From Native Americans and Spanish explorers in the early modern era to the influx of new residents in the 19th and 20th centuries, these aggregates and minerals — especially copper — have helped the state and Greater Phoenix serve as major players in the development of the United States.

With growing movements toward renewable energy solutions, copper mining is going to remain in fierce demand. Arizona, which produced 74% of the domestic copper in 2023, is a key player in going green.

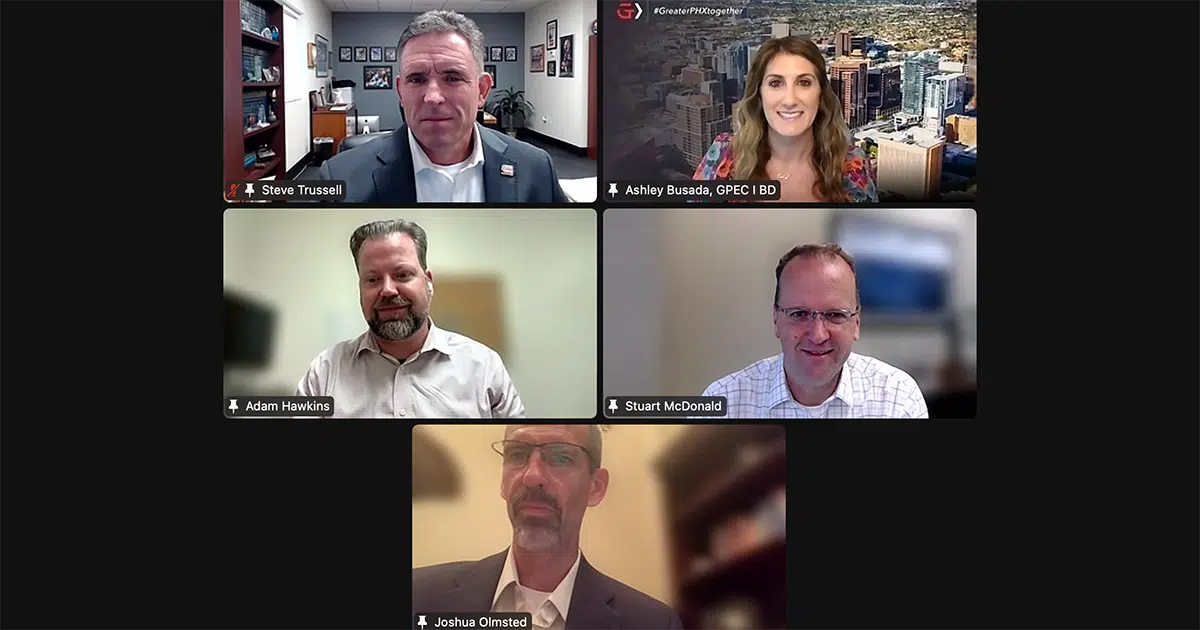

A group of local industry leaders joined the Greater Phoenix Economic Council (GPEC) to discuss the history of mining and its future supply and demand trajectory in a recent Regional Report with a live Zoom audience. The panel consisted of:

- Adam Hawkins, Founder & President, Global External

- Stuart McDonald, President & CEO, Taseko Mines

- Joshua Olmsted, President & COO, Freeport-McMoRan Americas

- Steve Trussell, Executive Director, Arizona Rock Products Association & Arizona Mining Association

- Moderator: Ashley Busada, Vice President of Business Development, GPEC

“Arizona’s critical role in the mining industry is a result of its rich mineral endowment, geologic diversity, historic significance, economic impacts, technological advancements, robust infrastructure, strong educational institutions and a supportive regulatory environment,” Trussell said. “These factors collectively will ensure that Arizona remains a pivotal state in the mining sector both nationally and globally.”

The history of Arizona mining

Since well before Arizona’s statehood in 1912, the region was a booming area for mining. Dating back to 1000 BC, Native Americans in the area extracted turquoise, coal, clay and other minerals mainly through surface deposits. Spanish explorers in the 1540s began to hunt for gold and silver, seeking the Seven Cities of Cibola across what is the southwestern U.S. today.

In 1854, the New Cornelia Mine in Ajo, Ariz. became the first modern copper mine in the state, creating an industry uptick over the next dozen years, by which nearly 25% of the male non-Native population worked as prospectors or miners, according to Trussell. In the 1870s, there was an uptick in lead, zinc and silver mining

By 1912, the new state supported 445 active mines, 72 concentrating facilities and 11 smelters. The influx of a diverse workforce fostered the development of railroads, schools, churches and more businesses, serving as a catalyst for vibrant growth over the next 100 years.

“Mining is a cornerstone of Arizona’s heritage and development, and has played a critical role in shaping the state’s economic, social and cultural landscape,” Trussell said. “The discovery of rich mineral deposits, particularly copper, silver and gold, resulted in significant population growth and infrastructure development, helping to transform Arizona from a sparsely populated territory into a booming economy.”

Today, the Arizona mining industry annually contributes $20 billion in total output and sales, with more than 27,000 direct jobs and nearly 75,000 jobs supported. In addition to serving as the largest U.S. copper provider, it is third in the nation in production of aggregates, which includes construction sand and gravel.

How copper will conduct the economic transformation of electricity

“Copper is the metal of electricity,” McDonald said. “Its required use in the power source, whether that’s renewable energy, solar, wind, any power generation facility all the way through the distribution network — wires, substations, transformers … all along that chain is copper.”

As the grid transitions away from fossil fuels toward renewable resources, Arizona, a top-five solar-producing state in the nation, is well-positioned to drive the future of electricity supply through renewable solar, geothermal and non-fuel mineral resources such as copper.

Freeport-McMoRan produces hundreds of million pounds of copper per year, with Olmsted projecting an increase of output to 400 million to 800 million pounds annually. Taseko projects to produce about 215 million pounds between its Gilbraltar mine in Canada and its Florence mine in Pinal County once the Florence Copper facility becomes operational in 2025, McDonald said.

That will help to fulfill increasing demand. In addition to technology like electric vehicles, the increase in housing construction and more countries gaining wider access to modern power capabilities will drive the demand of copper further, as 28% of global demand is tied to electric, housing and construction, according to Olmsted. Yet, the industry will need to address the fact that minerals are finite.

Olmsted said that modern technology has allowed stockpiles of materials with “unrecoverable” copper to become potentially viable. For instance, Freeport McMoRan plans to extract copper from waste rock as it accumulates.

“As technologies have advanced, as AI, cloud computing, data analytics have matured, it’s allowed us to look differently at those old historic stockpiles as another source,” Olmsted said.

The workforce will continue to mature along with technology, tying in automation, data analytics, instrumentations and sensors maintenance to the mining industry in addition to tradespeople like electricians, mechanics, welders, engineers and geologists.

Freeport-McMoRan focuses on workforce development through partnerships with community colleges and trade schools, including a recently announced partnership with Eastern Arizona College in Safford near its zero-discharge open-pit copper mining complex, working alongside Caterpillar to develop a diesel diagnostic apprenticeship program. The company also supports community action through work with Education Forward and conversations with K-12 schools to drive interest in the industry.

Additionally, Taseko provided 11 scholarships to students to pursue a related field of study and the mining association is working with a cohort of teachers in Tucson to help improve education methods for mining-related subjects.

Environmental impacts

Copper’s use in electrification could support the reduction of global carbon emissions by 16% by 2030, according to Freeport. Mining companies are looking into different techniques that can offset their own environmental impact to further contribute to the decrease in emissions by lessening their own carbon impacts.

Taseko’s Florence Copper mine is projected to be the lowest GHG-intensive primary copper producer in North America and have 75% less carbon emissions, use 65% less energy and 78% less water per pound of copper produced than convention open-pit copper mines. These efficiencies will be due to a variety of factors in its proposed extraction method, in-situ copper recovery, which will limit impacts on the topography with no open-pit or underground excavation, no waste rock or heap leach piles, and no blasting of mineralized material.

Freeport is a collaborator on programs with Caterpillar and Komatsu centered on developing zero-emissions mining trucks and supporting technologies and infrastructure. Related to this is the company’s plan to convert its fleet of haul trucks at the Bagdad, Arizona mine to be fully autonomous over the next three years, reducing idle time by 10,000 hours annually. This is part of Freeport’s decarbonization roadmap to achieve 2020 GHG emissions reduction targets and its 2050 net zero aspiration.

In 2023, 83% of Freeport’s water was from recycled or reused sources. Taseko seeks to supplement existing irrigation water sources on the on-site farm with surplus process water from the mine’s operations, potentially offsetting up to 1,466 acre-feet of water annually.

The Arizona mining regulatory landscape

One of the largest challenges for mining, the panelists said, is permitting, citing inefficiencies in the redundancy within the process. Mining companies are more cognizant of environmental impacts and serving in a sustainable manner, and run environmental impact analyses in their operations.

“Mining today is not the pick and shovels, and what it once was 100 years ago. We’ve very conscious of minimizing our impacts,” Olmsted said.

Hawkins added that in efforts to expand American manufacturing, improve upon electric vehicles and become home to the climate technology movement, each effort starts with copper and other minerals.

“I would ask my colleagues here in the business community to understand that everything that you do, I don’t care what business you’re in, everything you do starts with the periodic table. And everything on the periodic table either derives from things that are grown or things that are mined,” he said.

Mining and mineral usage have evolved throughout millennia to address the needs of communities and the world. The next world challenge, centered around moving away from traditional energy sources and toward more sustainable methods, will rely on renewable resources and non-fuel minerals such as copper to jumpstart its progress.

“The mining history in Arizona is a testament to human ingenuity and resilience. It underscores the state’s pivotal role in supplying essential minerals that fueled America’s industrialization while also shaping the unique character and heritage of region,” Trussell said. “Mining sustainability is all about maintaining our social license to operate, which is something modern-day mining companies take very seriously.”

Meet the panel

Adam Hawkins

Founder & President

Global External

Steve Trussell

Executive Director

Arizona Rock Products Association & Arizona Mining Association

Stuart McDonald

President & CEO

Taseko Mines

Ashley Busada (Moderator)

Vice President of Business Development

GPEC

Joshua Olmsted

President & COO

Freeport-McMoRan Americas